child tax credit 2021 portal

In recent weeks the IRS has sent millions of letters to eligible households who. Under the American Rescue Plan the IRS disbursed half of the 2021 Child Tax Credit in monthly payments during the second half of 2021 unless parents opted out of it.

How The 2021 Child Tax Credits Work Updated June 21st 2021 The Learning Experience

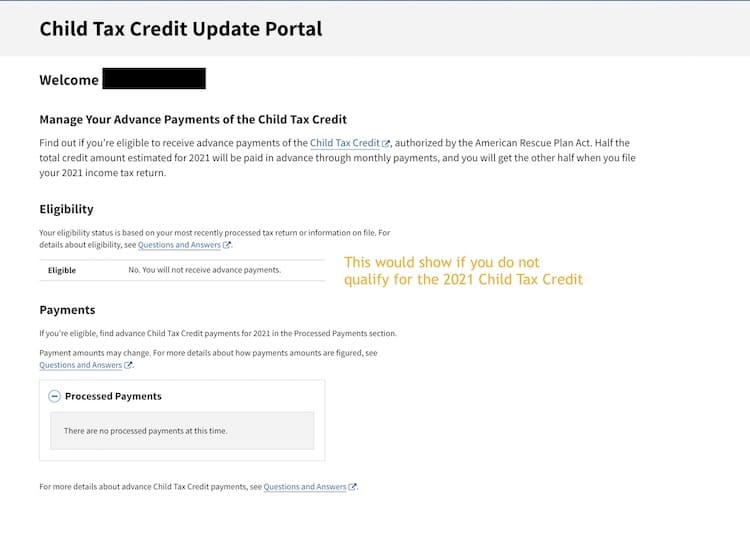

Get your advance payments total and number of qualifying children in your online account.

. This tool is designed to help families quickly and easily make changes to the monthly Child Tax Credit payments they are receiving from the IRS. IR-2021-235 November 23 2021 WASHINGTON The Internal Revenue Service this week launched a new Spanish-language version of the Child Tax Credit Update Portal CTC-UP. Join The Millions Who File Smarter And Get Your Taxes Done Right Guaranteed.

In previous years 17-year-olds werent covered by the CTC. For the september 30 2021 advance child tax credit payment taxpayers will only be able to unenroll and must do so no later. Child tax credit 2021 portal.

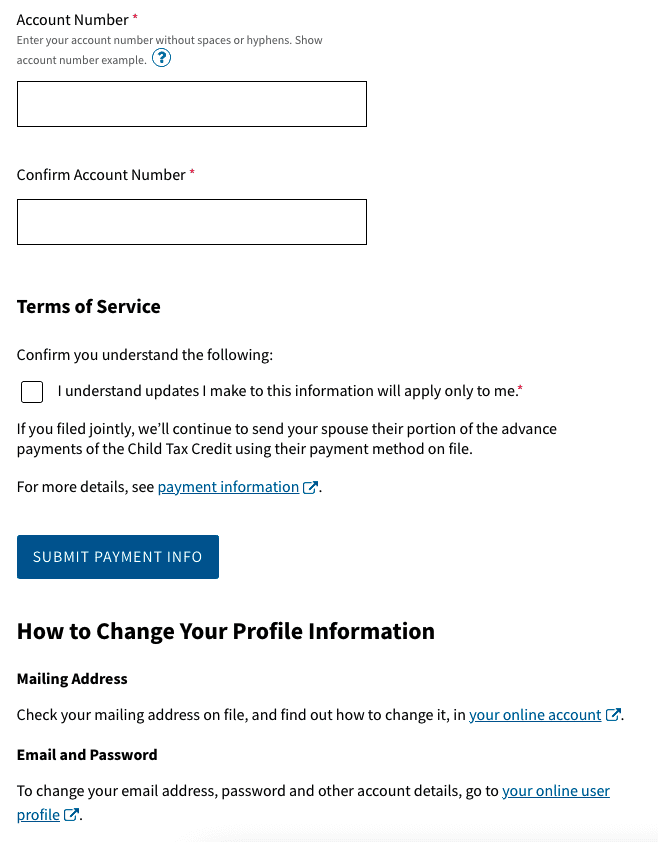

Here is some important information to understand about this years Child Tax Credit. The Child Tax Credit Update Portal allows you to verify your eligibility for the payments. Updates that have been made by August 2 nd 2021 will apply to the August 13 th payment as well as any.

The Child Tax Credit Update Portal has been updated to allow families to update their direct deposit information or to unenroll from receiving advance payments for the child tax credit. The United States federal child tax credit CTC is a partially-refundable tax credit for parents with dependent children. For 2021 the maximum child tax credit is 3600 per child age five or younger and 3000 per child between the ages of six and 17.

Enter your information on Schedule 8812 Form 1040. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child. You can also use the tool to unenroll from receiving the monthly payments if you prefer to receive a lump sum when you file your tax return next year.

Advance Child Tax Credit Payments in 2021. Taxpayers who paid childcare expenses while working or seeking work are eligible for the Child and Dependent Care Credit. You need to file a 2021 tax return to claim the remaining 2021 Child Tax Credit.

3600 for children ages 5 and under at the end of 2021. 16 hours agoScholl says that tax filing may also be complicated this year because of the advance child tax credit payments and the 2021 recovery rebate credit. Families with children are now receiving an advance on their 2021 child tax credit.

For the September 30 2021 Advance Child Tax Credit payment taxpayers will only be able to unenroll and must do so no later than September 27 2021. Our child tax credit calculator tells you how much money you might receive in advance monthly payments in 2021 and how much of the credit youll claim when you file your return next year. That total changes to 3000 for each child ages six through 17.

There are a number of changes to the CTC in 2021 because of the American Rescue Plan Act of 2021 which President Biden signed into law on March 11 2021. For the 2021 tax year the Child Tax Credit offers up to 3000 per child who is. 3000 for children ages 6 through 17 at the end of 2021.

It provides 2000 in tax relief per qualifying child with up to 1400 of that refundable subject to an earned income threshold and phase-in. The Child Tax Credit provides money to support American families. The advance is 50 of your child tax credit with the rest claimed on next years return.

Taxpayers can access the Child Tax Credit Update Portal from IRSgov. Having received monthly Child Tax Credit payments in 2021 and any refund you receive as a result of claiming the Child Tax Credit is not considered income for any family. For children ages 6 to 17 the credit increased from 2000 to 3000.

Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers. Feb 11 2022 If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. To reconcile advance payments on your 2021 return.

Novembers child tax credit cash will be sent out to parents in need across the country next week. It has gone from 2000 per. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to.

A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. The credit increased from 2000 per child to 3600 for each child under the age of 6. The Form 15323A GU must be filed at DRTs Income Tax Branch during business hours.

The IRS will make a one-time payment of 500. Find answers on this page about the child tax credit payment the calculator. The IRS recently upgraded the Child Tax Credit Update Portal to enable families to update their bank account information so they can receive their monthly Child Tax Credit payment.

If you received advance payments you can claim the rest of the Child Tax Credit if eligible when you file your 2021 tax return. The 500 nonrefundable Credit for Other Dependents amount has not changed. For 2021 eligible parents or guardians can receive up to 3600 for each child who was under 6 years old at the end of 2021 and up to 3000 for each child who was between the ages of 6 and 17.

June 28 2021. It also made the. COVID Tax Tip 2021-101 July 14 2021.

The Child Tax Credit Update Portal allows families to update direct deposit information or unenroll. 3 hours agoThe recurring 2021 child tax credit payments have ended but a new 2022 federal program could provide families with 4000 per child. Until the Child Tax Credit Update Portal is launched changes will only be submitted manually by using the Form 15323A GU.

Ad The new advance Child Tax Credit is based on your previously filed tax return. In the year 2021 following the passage of the American Rescue Plan Act of. This secure password-protected tool is easily accessible using a smart phone or computer with internet.

Ad Get Your Maximum Refund Guaranteed Even If Youve Received The Advance Child Tax Credit. You can use this Child Tax Credit portal to check your eligibility for the CTC. The Child Tax Credit does not affect your other Federal benefits.

The American Rescue Plan signed into law on March 11 2021 expanded the Child Tax Credit for 2021 to get more help to more families. The credit gives up to 300 per month per child under the age of six which totals 1800. Half of the money will come as six monthly payments and half as a 2021 tax credit.

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

2021 Child Tax Credit Steps To Take To Receive Or Manage

2021 Child Tax Credit Advanced Payment Option Tas

The Advance Child Tax Credit An Opportunity For Hud Assisted Families With Children Hud User

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

2021 Child Tax Credit Steps To Take To Receive Or Manage

Child Tax Credit Update Portal Update Your Income Details Review Your Payments And More Cnet

Child Tax Credit Update Portal Update Your Income Details Review Your Payments And More Cnet

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Irs Gives Taxpayers One Day To Rightsize Child Tax Credit November Payments November 1

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Irs Sends Millions Letters About The Monthly Child Tax Credit Payments Forbes Advisor

Child Tax Credit Dates 2021 Latest August 30 Deadline To Opt Out Of September Payments As Parents Flock To Irs Portal